Investments Funds

Equity Funds

Funds that mainly invest in shares of companies from various sectors and geographical areas at an international level.

- If you have a broad investment time horizon.

- More profitability opportunities with greater risk.

- Investment of at least 75% in equities.

Long-term investment instruments

Equity Funds invest most of their assets in shares. There is a wide variety of funds depending on the geographical area, the sector and the capitalisation of the companies in which they invest.

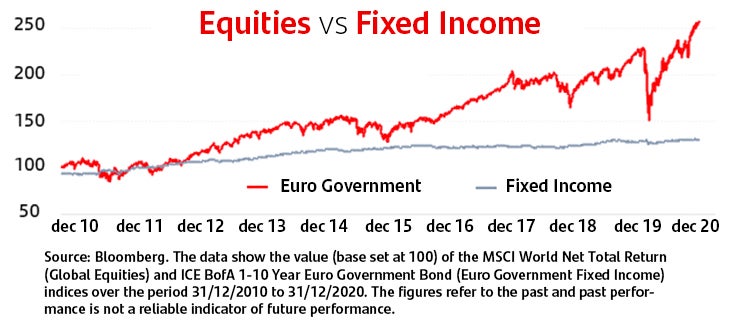

In general, they are investment products that tend to offer better performance data than other fixed income funds, but are also subject to higher risks. Investing in equity funds allows you to achieve potentially better results over an investment horizon of more than 3 years. Therefore, they are the most suitable option for those who seek to increase their capital and obtain higher income in the medium to long term, assuming the associated risks. .

Why invest in Equity Funds with Santander?

- Trust and security: we have the necessary experience and knowledge that allow us to offer simple and customized solutions that adapt to your investment needs.

- Santander Asset Management, S.A., S.G.I.I.C.: a global asset manager belonging to the Santander Group, with more than 200 specialists and with a presence in 11 countries, which focuses its activity on investment funds and tailored solutions for large companies.

Its analysis capacity and its strict risk control, as well as the knowledge of the different needs of its clients, are a differentiating element of Santander Asset Management, S.A., S.G.I.I.C.

You can also benefit from these characteristics of the investment funds:

Liquidity

The daily liquidity of our funds allows you to quickly dispose of the amount you need.

Taxation

Tax deferral since it can be transferred from one fund to another without fiscal cost, in the case of resident natural persons.

Diversification

Risk sharing among different financial assets.

Investing in funds implies assuming a certain level of risk that will depend on the composition of each fund, market fluctuations and other factors associated with investing in securities.

What risks does investing in these funds involve?

In general, investing in funds involves, among others, assuming the following risks:

Credit risk

Due to the quality of the assets in which it invests, as well as its issuers. It is the risk that the issuer will not be able to meet the payments.

Market risk

It is the possibility that financial instruments are listed or have a value below the price we have paid for them. In this sense, investments may be affected by:

- Riesgo de tipo de interés: las variaciones de los tipos de interés afectan al precio de los activos de renta fija. La sensibilidad a este riesgo depende de la duración de estos activos.

- Interest rate risk: changes in interest rates affect the price of fixed income assets. The sensitivity to this risk depends on the duration of these assets.

- Exchange rate risk: fluctuation of the exchange value in the case of assets denominated in currencies other than the reference of the participation.

- Market risk from investment in variable income assets: derived from variations in the price of equity assets.

- Risk of investing in emerging markets: Political changes or economic circumstances can affect the value of investments.

- Geographical or sectoral concentration risk: the concentration of our investment in the same area or sector increases market risk.

Investment in financial derivative instruments

Investing in derivatives (futures, options, etc.) may incorporate a higher risk given the nature of these products.

Liquidity risk

It is the risk that no counterparty is found in the market and, therefore, a product cannot be sold.

Sustainability risk

These risks correspond to environmental, social or governance events or conditions. The sustainability risk of investments will depend, inter alia, on the type of issuer, the sector of activity or its geographical location.

How can you contract this investment?

You can contract the Equity Funds online. If you are already a client, you can contract the Equity Funds online. If you prefer, you can contact us at your nearest Santander office .

Investment funds involve certain risks (market, credit, liquidity, currency, interest rate, sustainability risk etc.), and therefore some or all of the investment may be lost. The risks are set out in the fund's prospectus and Key Investor Information Document (KIID).

Before taking the decision to invest, you must consult the fund's prospectus and KIID, available from the supervisory body concerned, and also from the fund manager's website (www.santanderassetmanagement.es). The decision to invest in the fund must be taken in due consideration of all the characteristics or objectives of the fund described in the fund's prospectus and KIID. The investment advertised refers to the acquisition of stakes in an investment fund, and not in a certain underlying asset. Past performance is not a reliable indicator of future results, and if the fund is denominated in currencies other than the euro, it may experience increases or falls in performance as a result of monetary fluctuations.

The taxation of returns obtained from investments will depend on the tax legislation applicable to the personal situations of investors, and may vary in the future.

Management Company: SANTANDER ASSET MANAGEMENT, S.A., S.G.I.I.C., registered in the CNMV under number 12. Depositary Institution: CACEIS BANK SPAIN, S.A., registered in the CNMV under number 238. Marketing Company: BANCO SANTANDER, S.A., registered in the CNMV under number 49.

This is an advertising communication, for commercial purposes. It is not information that is contractually binding, it is not information that is required by any legal stipulations, nor should it be considered an investment recommendation or any form of advice, and it is not sufficient to take a decision to invest.

© BANCO SANTANDER, S.A. All rights reserved – registered office: Paseo de Pereda, 9-12. SANTANDER. Tax number A-39000013.

Equity Funds

- If you have a broad investment time horizon.

- More profitability opportunities with greater risk.

- Investment of at least 75% in equities.

Other related products

Mixed Funds

Diversify your investment, investing in fixed income, equities and other funds.

Fixed Income Funds

Learn about these funds that invest mainly in highly liquid and low-risk assets.

You might be interested in

Santander Blog

What is financial risk diversification?

FAQs

What is financial risk diversification?